The listing process

The listing process that leads a company to enter the capital markets involves the entrepreneur, the internal organization and the external advisers.

Listing on the stock exchange is a strategic choice that is reflected in all aspects of the ordinary course of business and in relations with the stakeholders. The outcome of the process depends not only on the characteristics and potential of the business, but also on the efforts made in the period leading up to the listing. In order to improve management systems which, once the company is listed, will ensure that all the crucial steps are adequately managed.

Start your journey towards excellence: assess the opportunity of listing on Borsa Italiana markets

Prepare the company

![]()

Getting ready for listing requires careful planning of preparatory activities by the company. In addition, the entrepreneur can adopt advanced management systems in the preparatory stage and also through a company's self-assessment.

This stage plays an essential role for the success of the entire process and the outcome depends on the efforts made during preparation, which is generally carried out with the support of a financial adviser.

An effective preparation process should focus on the following areas:

Areas |

Main points of attention |

Strategy |

Define value creation strategies for the actual and future shareholders |

Competitive sector and positioning |

Analyse the industrial sector where the company operates and its competitive positioning |

Historical financial data |

Audit financial statements and half-yearly reports, and pro-forma data for recent non-recurring transactions |

Prospective financial data |

Prepare a long-term business plan |

Group structure |

Identify which part of the group is most suitable for listing and ensure management autonomy to the company being listed |

Organizational and managerial structure |

Present the management team with adequate skills and professional experience, capable of ensuring the implementation of the strategic plans and objectives shared with market |

Corporate governance |

Implement procedures and practices for sound and fair company management, protecting the interests of minority shareholders and transparent decision-making towards the market |

Equity Story |

All these elements help define the issuing company’s profile to be presented to investors in order to stimulate their interest in the IPO |

Some aspects of the preparation may vary depending on the selected listing market.

Setting up the team

![]()

While listing is an extraordinary transaction for the company, it is ordinary business for specialized professionals.

It is necessary to have a management team with adequate skills and professional experience, in order to ensure that strategic plans and the value creation objectives presented to the market are implemented.

Specialized professionals of high reputation and who share the values of the company are essential pillars for a successful transaction.

The main advisers to be involved in the listing process are:

Listing Agent – for Euronext Milan market | Euronext Growth Advisor – for Euronext Growth Milan market | Global Coordinator | Legal Adviser | Auditing firm | Financial Adviser | Communication company

Assessing the investment

![]()

Unlike bank financing, listing costs incur only once, but they give access to the equity financing channel on a permanent basis.

Listing costs are often necessary investments to improve the company’s competitive strength and to adopt a more solid structure capable of facing the challenges of international growth. Therefore, it is important that the costs and benefits of listing be assessed jointly.

Listing costs depend on the listing market, the structure, size, sector and complexity of the company, the size of the offer, and the composition of the adviser team.

The 2025 Budget Law confirmed a 50% tax credit, subject to Eur 500,000 cap, for consulting costs incurred until 31 December 2027, finalized to listing on the Stock Exchange of Italian SMEs, as defined in EU law.

Download the new Harmonised Fee Book effective from 1 January 2026, applied to all Euronext Group Markets for Equity Instruments admitted to listing and trading from 1 January 2025 (ENG).

Consult the Harmonised Fee Book in force until 31 December 2025, applied to all Euronext Group Markets for Equity Instruments admitted to listing and trading from 1 January 2025 (ENG).

Kick-off the process

![]()

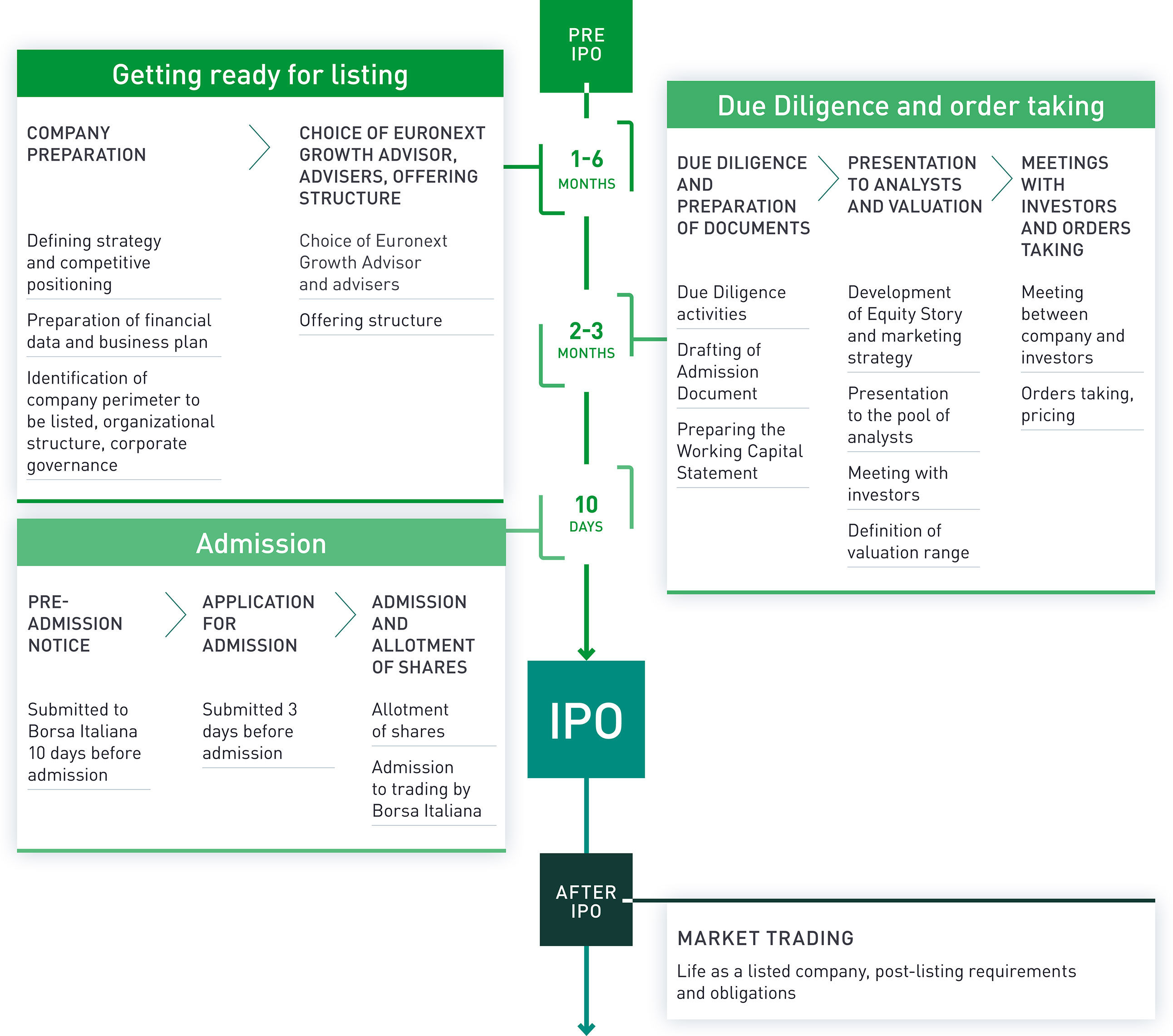

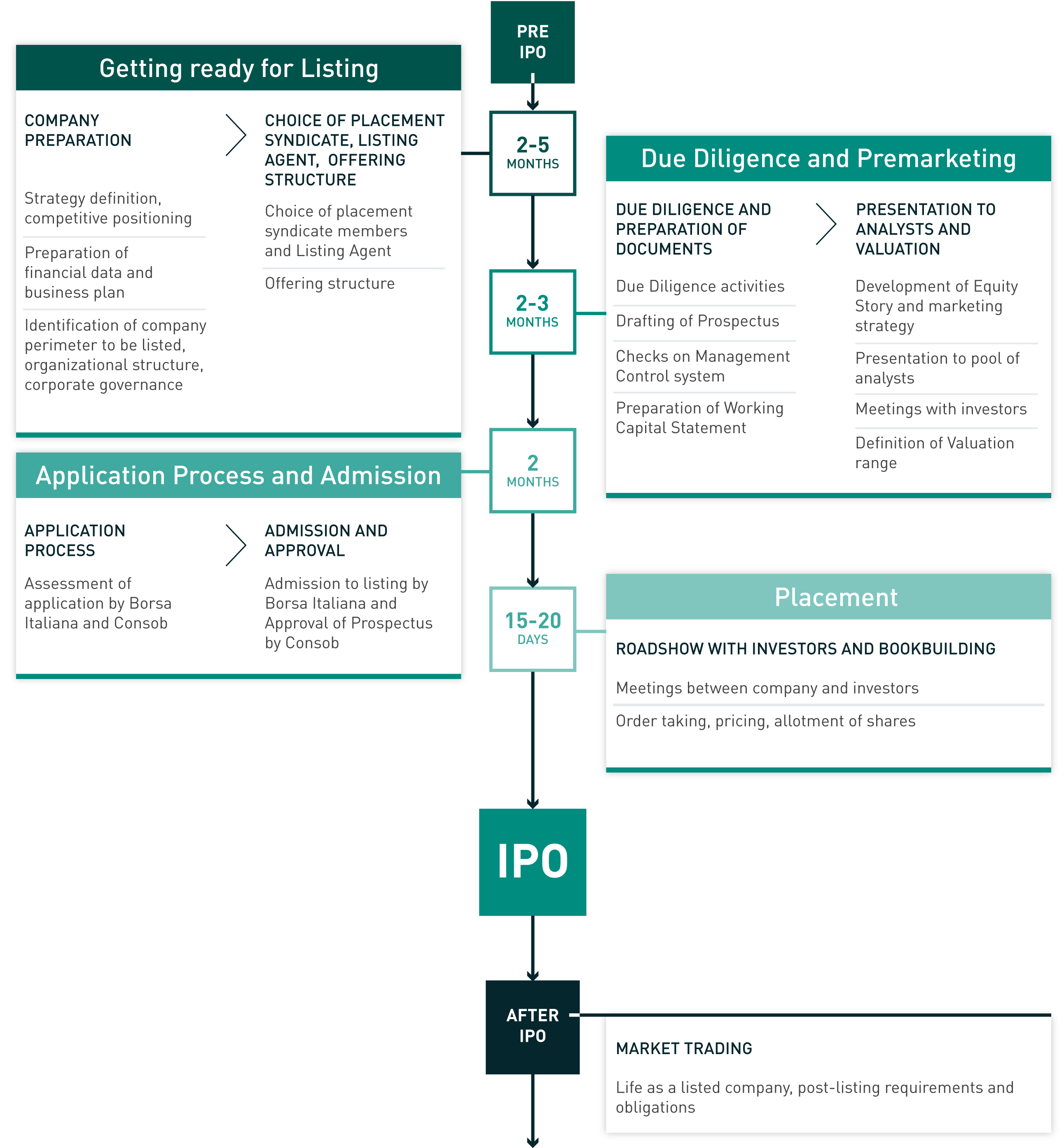

The IPO process consists of different steps depending on the selected market.

The listing process on Euronext Growth Milan market

The listing process on Euronext Milan market

To find out more, contact Borsa Italiana: borsaitalianaprimarymarkets@euronext.com

The Primary Markets team of Borsa Italiana is available to meet with entrepreneurs interested in the listing process and with their advisers in order to explore the company’s growth prospects and assess how Borsa Italiana can support them.

Discover more about:

Whether you are a fast-growing SME or a larger company, going public on Borsa Italiana, part of Euronext Group, provides capital to help finance your growth and boost your profile with all stakeholders.