Equita - ENI leads the way for retail investors, giving access to ESG issues

The €2 billion ENI issuance has re-opened a huge portion of the Italian debt capital markets, represented by the general public, strongly supported by the increasing popularity of ESG instruments.

Equita, 27 Feb 2023 - 10:25

It is no surprise that the latest hot topic in the financial industry is ‘sustainability’. It involves multiple entities from different points of view: the general public has casted the first stone, increasing pressure over both governments and private entities, such as corporations of any size, to put the spotlight on ESG topics, permeating financial players in all aspects. Authorities are hardly trying to keep up with the regulation as financial markets evolve rapidly, in parallel with social and environmental aspects, especially in the debt capital markets. Non-government ESG issues are dominating the scene: over 2022, the amount collected by Italian corporates through ESG issues represented over 70% of total amount.

At the same time, the Italian household gross financial wealth[1] has never been higher. According to Bank of Italy, at the end of 2021, it reached over €5,237 billion, growing by +6.6% compared to 2020. Over 30% of Italian citizens’ portfolio is represented by uninvested liquidity, while the share of debt securities stands at only 4% in 2021 (it represented over 20% in 2011), hinting that there is significant room to increase the portfolio share of debt instruments.

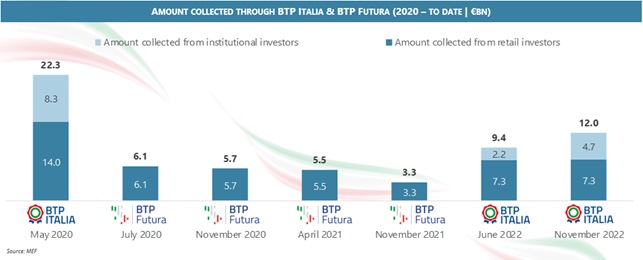

Considering the complex market momentum – driven by increasing inflation, rates hikes by central authorities, such as the Federal Reserve or the European Central Bank, prolongation of the effect of the Ukraine-Russia conflict – the interest of retail investors towards safer and less volatile assets such as bonds has increased rapidly. The hanger of Italian savers to invest in debt instruments has become apparent in the context of the placement of the latest BTP Italia in November 2022: the Ministry of Economy and Finance has collected ca. €7.3 billion from over 255.700 retail investors, denoting massive interest toward this type of instrument. Since 2020, the Italian Government has collected ca. €50 billion from retail investors out of €64 billion, through both BTP Italia and BTP Futura. However, Government-issued instruments represent only a portion, although meaningful, of the Italian debt capital market, and yet with a relatively low yield. Expect for governments’ bonds, retail investors do not currently dispose of a wide range of investment options to choose from.

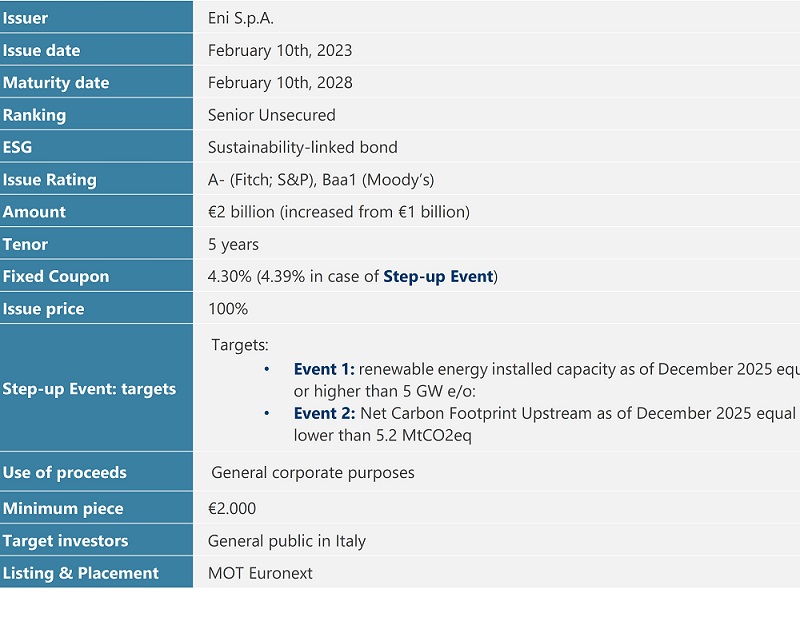

Recently, the retail investors’ appetite has finally crossed path with the will of investing in environmental, social and governance-impactful instruments on the primary market. In fact, at the beginning of the year, precisely on the 20th of January, ENI closed the offer in advance for its first sustainability-linked bond dedicated to the general public in Italy. The issue received orders from over 300,000 individual investors for over €10 billion, compared to €1 billion initially offered, then increased to €2 billion to meet the high demand from Italian investors, strongly supported also by a strong rating profile and an attractive initial yield (4.30%) (ISIN: IT0005521171). Equita participated as dealer, collecting requests from over 33,000 individual investors for a total amount of over €1.1 billion.

ENI is acting as forerunner for frequent issuers in the Italian corporate debt space, allowing the general public to get access to primary issuance of a frequent issuer. Furthermore, the issuance also satisfies the will of the general public to pursue their interest for a positive environmental impact, combining also appetite for returns. In fact, the last coupon payable in 2028 is linked to the achievement of the following sustainability targets (as defined in Sustainability-Linked Financing Framework of 2021):

- reduction of net greenhouse gas emissions (Scope 1 and Scope 2) associated with Upstream business activities. In particular, the target is to reduce the Net Carbon Footprint Upstream (Scope 1 and 2) indicator to a value equal to or lower than 5.2 MtCO2eq as of December 31, 2025 (-65% compared to the 2018 base-year); and

- increase of the renewable installed capacity up to a value equal to or greater than 5 GW as of December 31, 2025.

If one of the two targets will not be achieved, the coupon payable at maturity will undergo an increase of 50 basis points.

However, it is worth mentioning that the sustainability-linked bond of ENI does not represent the very first ESG-labeled bond available to the general public in Italy. Indeed, few more retail bonds have been recently issued by Italian corporates such as Alerion Clean Power S.p.A. (“Alerion”) and OVS S.p.A. (“OVS”). Alerion, the Italian leading onshore wind operator, issued a 6 years green bond in May 2022, for a total amount of €100 million (third green issuance) with a fixed coupon of 3.50%. OVS S.p.A., instead, issued a 6 years sustainability-linked bond in November 2021, for a total amount of €160 million and a fixed coupon of 2.25%. The apparel retail chain, participated also by Tamburi Investment Partners, represents the first sustainability-linked bond dedicated to the general public. In fact, the coupon could undergo a step-up of up to +25 basis points if the issuer does not achieve one or more of the three sustainable targets by 2024. In both transactions, Equita acted as placement agent, as it represents a forerunner in ESG issues dedicated to the general public.

The above-mentioned case studies are just the tip of the iceberg of what could come next. The massive interest of retail investors for returns ESG-labeled is beyond question: the possibility to combine individuals’ appetite for returns together with the will to positively, nevertheless indirectly, contribute to society, investing in any sort of ESG category, creates an explosive mix that could widen the market share of retail-dedicated instruments as well as ESG segment.

Furthermore, on the basis of the success of ENI issuance, an increasing number of frequent corporate issuers, both High Yield and Investment Grade, may peek-in to test the retail segment, allowing Italian savers to get access to institutional instruments - historically a privilege of institutional investors only - as well as diminish the gap between Italian champions and savers.

Almost 20 years have passed since the first discussion on how to include some sort of ESG criteria into investment decision of retail investors, when the International Finance Corporation published the report ‘Who Cares Wins” (2004) in partnership with the United Nations. Although a lot, perhaps too much, time has passed, the first strong signals are starting to be noticed: ESG factors are seen as increasingly important by investors as they look beyond traditional metrics like earnings and revenue, and consider the impact of a company on the environment and society, as they align their investments with their personal values. Therefore, we can definitely expect retail investors to play an important role in the primary ESG market over the next 3 to 5 years.

[1] Figures include currency and deposits, debt securities, loans, shares and other equity, derivatives, mutual fund shares, insurance, pension and standardized guarantee schemes, and other accounts receivable

It is the sole responsibility of the Sustainable Finance Partner to check the truthfulness, accuracy and completeness of the data and information entered on this web page, when within its competence and provided by the Partner. Borsa Italiana S.p.A. is not responsible for the contents developed by third parties and in particular by the Sustainable Finance Partners contained in this web page.

Glossario finanziario

Hai dei dubbi su qualche definizione? Consulta il glossario finanziario di Borsa Italiana.