Moody's Ratings - Sector gaps to net zero are key to transition plan credibility

In sectors with the largest gaps to reach net zero, even those companies with the strongest carbon transition plans may be less credible, Moody’s Ratings analysis finds.

Moody's Ratings, 30 Giu 2025 - 09:56

In sectors with the largest gaps to reach net zero, even those companies with the strongest carbon transition plans may be less credible, Moody’s Ratings analysis finds.

Moody’s net zero assessments (NZAs) provide an opinion on an entity's ability to achieve emission reduction goals compared with global pathways including the International Energy Agency's (IEA) net zero emissions by 2050 scenario (NZE). NZAs do not address the credit implications of carbon transition, which depend on actual policies implemented.

Over 7,000 companies have science-based targets to reduce carbon emissions, according to the Science Based Targets initiative, although policy and actual emission trends substantially lag NZE.

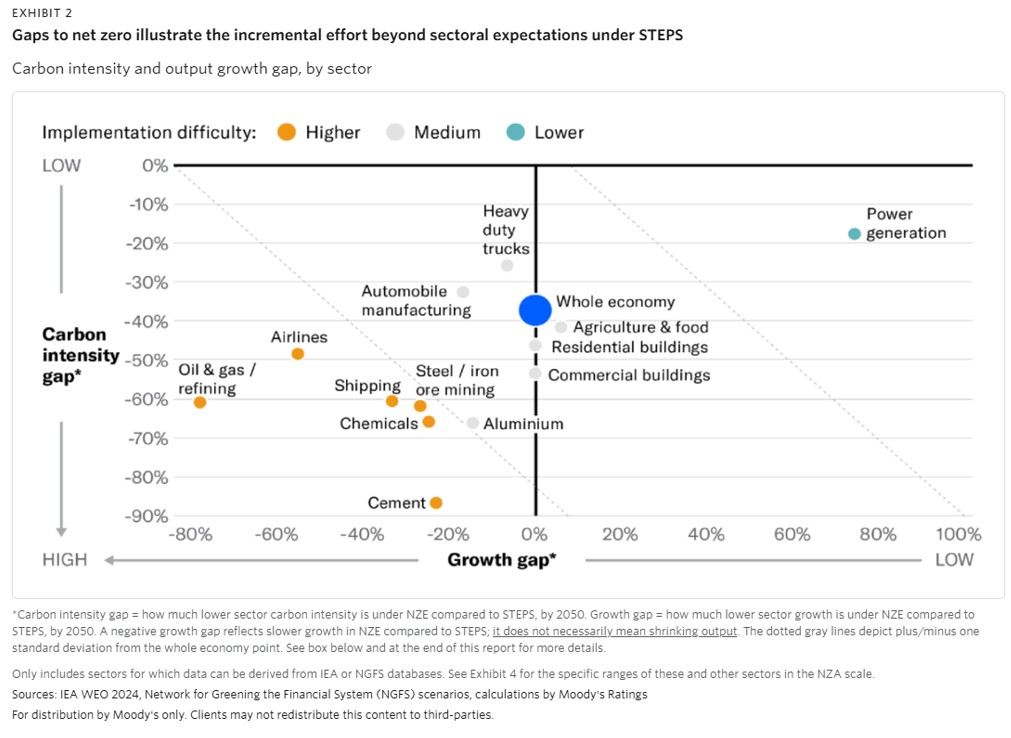

Analyzing the difference between what is needed to meet net zero and what is likely by 2050 (the gap to net zero) illustrates the varying difficulty to align with a global net zero pathway for each industry. For individual companies within these sectors, this determines the NZA scores they may be able to reach, even with high-quality carbon transition strategies.

Moody’s finds that companies in the oil and gas, refining, airlines, shipping, steel, chemicals and cement sectors would need to make the biggest shifts to reach net zero targets, by reducing carbon intensity more rapidly or by growing slower to stay within sectoral carbon budgets.

In these industries where implementation difficulty is high, the NZA score, even for the strongest plans, will typically be lower (see exhibit). This reflects the fact that outperforming peers in carbon efficiency might imply higher costs for a company, while underperforming them in terms of growth could imply a loss of market share. The larger the sectoral growth gap, the greater the difficulty of achieving 1.5 C transition plans in the sector.

Within the high implementation difficulty group, an NZ-3 (significant) or NZ-4 (constructive) might be the highest achievable NZA score. This is because either their plan is aligned with 1.5 C but the implied deviations from business-as-usual are so large that they become highly difficult to achieve, or because their plans are aligned with a higher temperature outcome with a better chance of achieving them.

For sectors facing medium implementation difficulty, the stronger transition plans would typically achieve scores up to NZ-2 (advanced). This includes sectors such as agriculture and food, automobile manufacturing, real estate, aluminum, and heavy duty trucks, including manufacturers and freight companies.

In addition, indirect value chain emissions pose substantial hurdles for oil and gas, and iron-ore mining. Not only are carbon intensity and growth gaps significant, but the bulk of emissions in these sectors typically occur downstream of operations, meaning companies have less control over them. Based on our analysis, we expect the highest achievable NZA in these sectors will generally be NZ-4. While some other sectors face similar obstacles, they usually have lower gaps to net zero, and better options to shift their product mix and reduce emissions.

Additional factors outside companies' control also influence transition plan credibility. These factors may include availability of resources for decarbonization, regional regulations and energy security focus in the territory of operation. Companies heavily focusing on enabling activities, such as steel for wind turbines or lithium mining, may reach stronger scores than the sector average. However, the degree to which they will be able to reach scale with these products also often depends on external factors. The influence that individual companies can have over value chain emissions may also vary within a sector, and is an important differentiating factor.

It is the sole responsibility of the Sustainable Network Member to check the truthfulness, accuracy and completeness of the data and information entered on this web page, when within its competence and provided by the Sustainable Network Member. Borsa Italiana S.p.A. is not responsible for the contents developed by third parties and in particular by the Sustainable Network Member contained in this web page.

Glossario finanziario

Hai dei dubbi su qualche definizione? Consulta il glossario finanziario di Borsa Italiana.