Moody’s - Focus on nature risks is rising despite mixed COP16 progress

Progress on COP16's key objectives – including strengthening monitoring on commitments and mobilizing finance – comes as businesses are increasingly acting to address credit exposure to nature risks.

Elise Gilliam, Sarah Conner and James Southwood, 31 Mar 2025 - 09:58

On 28 February 2025, a resumed session of the United Nations (UN) biodiversity conference (COP16) concluded in Rome. Progress on the summit's key objectives – including strengthening monitoring on commitments and mobilizing financing – comes as businesses are increasingly taking action to address credit exposure to nature risks, such as by integrating nature considerations into financial disclosure (see Exhibit). Moody’s believes that momentum is likely to build, with interlinkages between climate, nature and energy set to be a key theme at the 2025 UN Climate Change Conference (COP30) in Brazil in November.

Despite the progress made, COP16 highlighted obstacles to financing global biodiversity efforts. The summit closed with agreements on a new resource mobilization strategy – with an unprecedented focus on private-sector contributions – and a road map to establishing a permanent financial mechanism in 2028. Parties also selected indicators to measure progress against the goals of the Kunming-Montreal Global Biodiversity Framework, and advanced work on planning, monitoring and reporting. However, in Moody’s view, the impact of these decisions will hinge on implementation and funding commitments.

Moody’s expects the outcomes of COP16 to support continued growth in nature-related sustainable debt issuance. The share of use-of-proceeds from sustainable issuance used for nature-related spending has grown for four consecutive years, and reached 14% of total issuance in 2024. This growth is driven by sovereigns and supranationals who are leveraging nature-related bonds to further their conservation objectives. Europe dominates biodiversity-related issuance, but investment needs for nature-based solutions are greatest in Asia, according to UN estimates. Demand for adaptation finance will likely further drive nature-related investment.

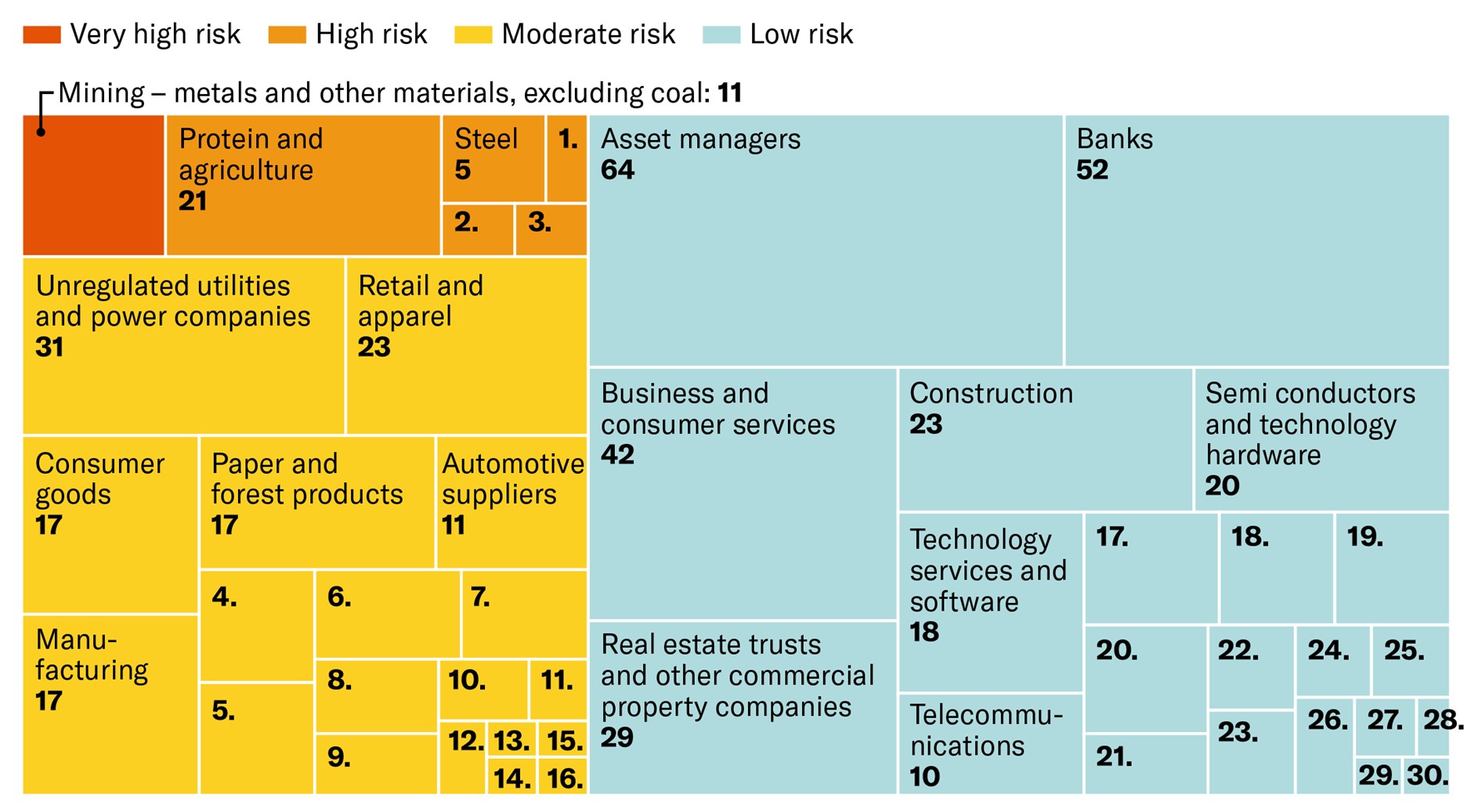

Measurement of nature-related risk is key to mobilizing capital at scale and limiting exposure across sectors and regions. The integration of nature into financial reporting and strategy considerations is not yet widely adopted, but recognition of financial and reputational risks associated with nature, and regulatory pressures in some quarters are driving action. Eight sectors with $1.6 trillion in rated debt had very high or high inherent exposure to risks related to natural capital in 2024, according to Moody’s analysis, highlighting the increased regulatory and investor focus on natural capital.

Looking ahead to COP30, Moody’s expects that nature integration in decarbonization plans will be a prominent topic and that biodiversity-rich sovereigns, particularly emerging markets, will be in the spotlight as the summit convenes in the Amazon. Host Brazil is focused on land use and biodiversity, setting the stage for discussion on the links between climate, nature and clean energy.

Exhibit

Title: Over 500 organizations and nearly $18 trillion of assets under management are now committed to Task Force on Nature-related Financial Disclosures (TNFD)-aligned risk management and reporting

Subtitle: Number of TNFD adopters by sector and natural capital risk exposure

Sources: TNFD and Moody’s Ratings

Sources: TNFD and Moody’s Ratings

It is the sole responsibility of the Sustainable Network Member to check the truthfulness, accuracy and completeness of the data and information entered on this web page, when within its competence and provided by the Sustainable Network Member. Borsa Italiana S.p.A. is not responsible for the contents developed by third parties and in particular by the Sustainable Network Member contained in this web page.

Hai dei dubbi su qualche definizione? Consulta il glossario finanziario di Borsa Italiana.