Credible transition plans support access to finance, says Moody's

Moody’s net zero assessments highlight that credible transition plans have pragmatic objectives, and are aligned with companies’ commercial strategies and shareholders’ expectations.

Vincent Allilaire, Vice President, Senior Credit Officer, and Swami Venkataraman, Associate Managing Director, Global Head of Sustainable Finance Assessments at Moody’s Ratings, 28 Ott 2025 - 10:58

Evolution in regulation, reporting standards and stakeholder interest is prompting companies to improve disclosure of their carbon transition plans. However, inconsistency in publication and variance in quality have bolstered the popularity of external validation. Several providers now exist worldwide: some focus on target evaluation, while relying only on public disclosures; others also evaluate implementation and governance through engagement with the company.

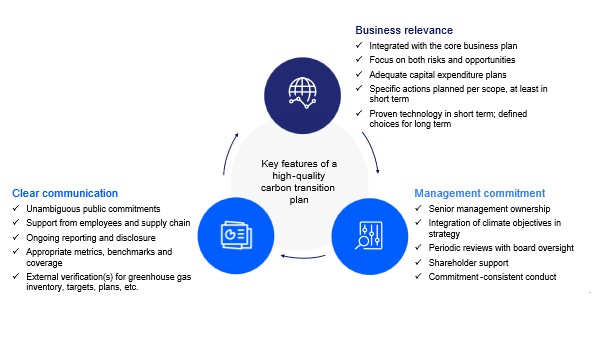

Moody’s net zero assessments (NZAs) highlight that business relevance, management commitment and clear communication are key ingredients of a credible transition plan, and fundamental to supporting regulatory reporting requirements and gaining support from stakeholders. In Moody’s experience, transition plans are most likely to be successful when aligned with the company's broader strategic aims. This involves a strong governance process that includes senior management ownership, periodic reviews and public commitments, which will allow the plan to evolve and adapt to business cycles. It will also involve support from shareholders and supply-chain partners. Credible plans can mitigate credit risk from transition if they address risks and seize related opportunities. According to Moody’s annual environmental risk map, 16 sectors with $5.0 trillion in rated debt have elevated credit exposure to carbon transition risks.

Looking at the companies with the strongest NZAs, a number of features become clear. These plans use metrics and key performance indicators that are appropriate for the company and its business model, and cover all significant emissions across the company’s value chain. Credible plans also set realistic decarbonisation objectives, in keeping with the sector and countries of operation. Moody’s NZA analysis uses benchmarks that reflect the slower pace at which emerging markets are likely to transition compared with advanced economies. For example, using the Asia-Pacific utilities benchmark allowed us to assess Hong Kong-based CLP Holdings Ltd.'s targets in the context of regional transition expectations.

The most credible plans describe how the company will reach its objectives. They detail the specific actions envisaged, together with carefully assessed impacts on emissions and on the company’s business performance. Given commercial sensitivities, companies rarely publicly disclose such plans in detail, generally choosing to report more aggregated figures, highlighting the benefit of engaging directly with the company.

Exhibit: Credible plans focus equally on technical, financial and business viability

Source: Moody’s Ratings

When investors can assess the credibility of a plan, this may strengthen the company's access to financing, whether through labelled or unlabelled markets. There is a strong global policy and market focus to scale transition finance, especially in emerging markets and hard-to-abate sectors. A number of efforts are underway globally to go beyond the traditional green/non-green binary to more precisely define and promote transition finance.

By boosting investor confidence, clarification of transition plans can facilitate market reception when companies issue transition-related instruments. Italian energy infrastructure company Snam S.p.A. published long-term targets and a detailed transition plan, along with an NZA, in early 2024 that helped clarify the opportunities and hurdles it faced in its long-term transition. Given Snam’s position as part of the fossil fuel value chain, the NZA analysis was a significant focus of the second party opinion related to the launch of its sustainability-linked bond program and helped with its issuance to date of EUR5.7 billion.

A credible transition plan can also have significant investor engagement benefits. Most companies Moody’s has assessed publicly, such as Engie SA and EDF SA, have leveraged the NZA for high-profile events, such as a strategy update, an investor day or an annual results presentation. Companies including Verbund AG and China’s GDS Holdings Ltd. have also chosen to publish their scores alongside the release of new or updated transition plans, to allow investors to easily assess their credibility.

It is the sole responsibility of the Sustainable Network Member to check the truthfulness, accuracy and completeness of the data and information entered on this web page, when within its competence and provided by the Sustainable Network Member. Borsa Italiana S.p.A. is not responsible for the contents developed by third parties and in particular by the Sustainable Network Member contained in this web page.

Hai dei dubbi su qualche definizione? Consulta il glossario finanziario di Borsa Italiana.