Morningstar - Mapping ESG Practices in 48 Countries' Stock Markets

Despite being home to several sustainability leaders, the U.S.' overall ranking is dragged down by a few companies with high ESG risks.

Morningstar, 06 Mag 2022 - 11:15

The market and political turmoil brought about by Russia's invasion of Ukraine has provoked much discussion on sustainable investing, especially around values-based exclusions (military contractors and fossil fuels, above all). However, as Morningstar's director of sustainability research for the Americas Jon Hale put it, such critiques are unsupported by the data. For the most part, these claims reflect a total lack of understanding of the diversity of the field.

One of the economic lessons to emerge from this conflict concerns the risk in investing in countries where politics can strongly condition free economic activity and where corporate governance is affected by rules set by the person in charge. In the end, when it comes to investing in autocratic countries such as Russia, the normal rules of picking stocks and bonds can be rendered irrelevant overnight.

Despite all the challenges of the moment, the long-term case for environmental, social, and governance investing remains encouraging. The fact that ESG screens led to resilience during the pandemic-driven market turmoil, owing to the relationship between sustainability and attributes like corporate quality and financial health, supports the view that ESG risk is material.

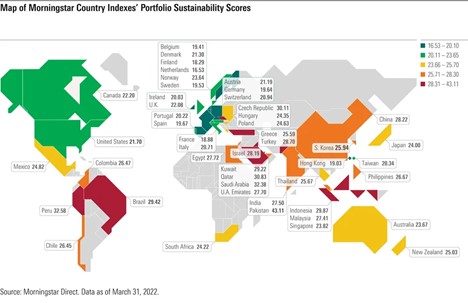

According to the latest edition of the Morningstar Sustainability Atlas, European countries--particularly those in the north--lead the pack in ESG practices. These nations have always been ahead of the curve on ESG, but a few other countries also feature exceptionally strong sustainability profiles. Financial advisors and asset managers can use this data to identify countries with the greatest ESG investment opportunities and most significant risks.

The Morningstar Sustainability Atlas uses the constituents of Morningstar country indexes to examine the sustainability profiles of 48 country-specific equity markets. The company-level scores are sourced from Sustainalytics, which is a Morningstar company whose metrics also power the Morningstar Sustainability Rating for funds.

Morningstar Portfolio Sustainability Scores: The Netherlands Maintains Its Spot at the Top, China Plummets

As with previous editions of the Sustainability Atlas, the Netherlands continues to have the world's most sustainable stock market.

Behind the Netherlands, Finland overtakes France for second place in the rankings. This is primarily due to big companies like Nokia (NOK), a leader within the global technology hardware industry, and Sampo, another important name in the insurance services' sector.

France falls to third place. Important French constituents like global producer and distributor of luxury goods LVMH, electrical equipment supplier Schneider Electric, and personal-care company L'Oréal are classified as ESG leaders in their industries.

Particularly noteworthy is Belgium, which rebounds from 18th place in 2021 to fifth place this year, thanks to the excellent performance of KBC Group. At the same time, Taiwan slips from fifth to 11th place. Spain loses two positions to eighth place, while Sweden climbs from seventh to sixth place.

Hong Kong ranks fourth and is the most sustainable non-European market. Insurance company AIA Group--by far the biggest name within the benchmark--combines low risk exposure with strong management.

The United States ranks 16th out of 48. U.S. companies like Apple (AAPL), Microsoft (MSFT), Berkshire Hathaway (BRK.A), and Nvidia (NVDA) are considered leaders from a sustainability point of view; on the other hand, the Sustainalytics ESG Risk Ratings for big names such as Amazon.com (AMZN), Meta (FB), and Exxon Mobil (XOM) are classified as High. This is attributable in most cases to the companies' involvement in controversies.

For example, Amazon's disruptive expansion has led to rapid growth but has drawn intense scrutiny from regulators, governments, and competitors for potential breaches of antitrust laws and anticompetitive behavior. The coronavirus pandemic indicated more systemic occupational health and safety issues, particularly among the warehouse employees, who were exposed to poor safety measures during the pandemic's early stages.

At the same time, Meta continues to face multiple lawsuits and fines over privacy violations and its data usage practices, suggesting gaps in management's controls.

China lands at the bottom of the fourth quintile, ranking 39th out of the 48 markets, and losing nine positions compared with last year. Internet giant Tencent is the biggest name within the index, followed by Alibaba (BABA). Both companies hold a Medium ESG Risk Rating and have a concerning involvement in controversies.

Important Note: In light of the Russian invasion of Ukraine and the resulting sanctions issued by the U.S., European Union, and United Kingdom, Morningstar moved the Russia equity market from emerging-markets status to unclassified. This took effect at the rebalance after the market close on March 18, 2022, when all Russia equity securities, including ADRs and GDRs, were removed from the Morningstar Global Markets and Morningstar Target Market Exposure index families at a price of zero. This reflects the fact that many investors outside of Russia can no longer trade these securities. Consequently, the Russian equity market was not taken into consideration for this analysis.

It is the sole responsibility of the Sustainable Finance Partner to check the truthfulness, accuracy and completeness of the data and information entered on this web page, when within its competence and provided by the Partner. Borsa Italiana S.p.A. is not responsible for the contents developed by third parties and in particular by the Sustainable Finance Partners contained in this web page.

Hai dei dubbi su qualche definizione? Consulta il glossario finanziario di Borsa Italiana.