Cerved - ESG in credit rating: the empirical evidence of Cerved Rating Agency

Cerved Rating Agency’s study, presented at the second edition of the ESG Connect event, highlighted how ESG factors have in some cases had a decisive weight for the assignment of credit rating, both in an upgrade and downgrade perspective.

Cerved Rating Agency, 19 Ott 2022 - 10:35

In recent years, the prudential supervision bodies have contributed to the launch of a virtuous path of sustainable finance addressed to the main operators on the European landscape, facilitating the disclosure and integration of ESG policies within the traditional creditworthiness assessment measures. In this context, rating agencies have had a focal role since the very beginning, as recognised rating providers and active contributors to the stability of the financial system.

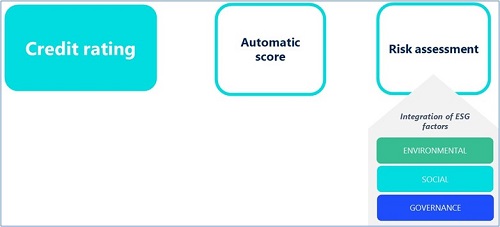

In fact, in 2019 ESMA (European Securities and Markets Authority, regulator of European credit rating agencies) has launched guidelines aimed at improving the disclosure of sustainability profiles and assessments where applicable in credit ratings. In compliance with these regulatory recommendations and in line with its leadership role on the European market in terms of number of issued ratings, Cerved Rating Agency has publicly explained how it assesses ESG risk factors in the qualitative component of its credit rating model, expressed by the analytical evaluation. In the risk assessment process, which integrates the purely statistical evaluations deriving from automatic scores, the analyst has the possibility to assess the materiality of ESG factors that may have an impact on the assessment of creditworthiness as outlined in the publicly available credit rating methodology.

Specifically, the empirical analysis of the risk assessment processes has shown that all three sustainability components have had a differentiated weight in the attribution of credit risk.

In particular, the governance elements relating to transparency in disclosure, negative elements borne by management and the virtuosity of the Corporate Governance organisational models have constituted key elements in the evaluation of the creditworthiness compared to the other Environmental or Social components.

With regard to environmental and social factors, some variables such as the compliance with environmental policies and GHG emissions, as well as welfare and employee protection procedures, have represented elements of material impact on the credit risk assessment criteria, with different graduality depending on sectorial characteristics.

The abovementioned factors have been the elements that, together with other more traditional evaluation criteria, contributed to the agency's credit rating actions. According to the empirical evidence of the Italian rating agency, it has been observed that in 46% of cases these factors led to a confirmation of the rating, in 13% of cases to an upgrade and in the remaining 41% to a downgrade.

More specifically, if only variations of credit rating class are analysed, the different intensity of the ESG factors varies as follows: for 4% they involved an upgrade of 2 or more classes and for 19% the upgrade of one class. In contrast, 32% of the cases resulted in a downgrade of one class and 45% of two or more classes.

This empirical evidence provides a significant picture of the impact of ESG factors in determining creditworthiness and can also be considered as an important step forward in the broader path of sustainable finance already encouraged in recent years at a regulatory level and which perceives the Credit Rating Agencies as important contributors to the stability of the financial system and vehicles for the inclusion of all components of the industrial scenario.

ratingagency.cerved.com

It is the sole responsibility of the Sustainable Finance Partner to check the truthfulness, accuracy and completeness of the data and information entered on this web page, when within its competence and provided by the Partner. Borsa Italiana S.p.A. is not responsible for the contents developed by third parties and in particular by the Sustainable Finance Partners contained in this web page.

Hai dei dubbi su qualche definizione? Consulta il glossario finanziario di Borsa Italiana.