The new trading hours for the IDEM market

FTA Online News, Jan 31 2020 - 12:13What changes for the IDEM Market on February 17th?

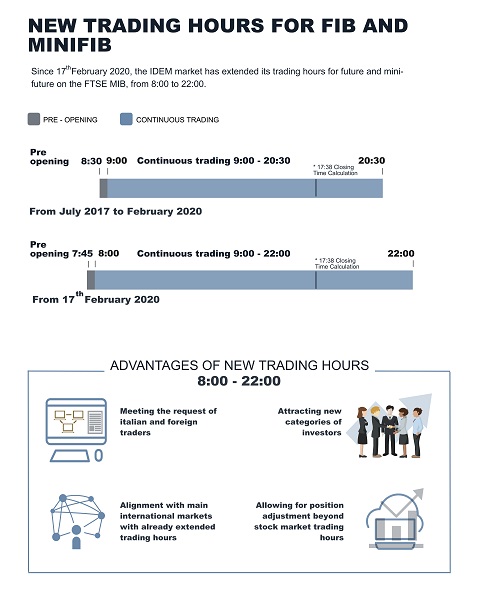

On February 17th, Future and Minifuture trading hours of the IDEM Market will be extended. The continuous trading session will span from 8:00 to 20:00. Each session will be as follows:

- pre-market stock trading from 07:45 to 08:00 (pre-market, validation, opening)

- the continuous trading session will begin at 08:00 (against today’s opening time at 9:00)

- the continuous trading session will end at 22:00 (against today’s closing time at 20:30)

What are the implications of this change?

In derivatives markets, trading hours are often extended beyond standard limits in order to attract new investors, who may be appealed by the opportunities associated with an extension. Online Brokers and foreign professional operators have indeed shown the need for trading hours to be extended. For example, thanks to the extension of Borsa Italiana’s Future and Minifuture trading hours until 22:00 (Wall Street closing time), US operators will gain extra time to trade on the Italian market.

The extension of trading hours on futures within Borsa Italiana’s basket trade (occurred in 2017) has already led to a 2% increase in volumes for what concerns the FIB and about 3,7% for the MiniFIB. The evening trading session is characterized by the presence of high trading volumes, which may amount to as much as 10% of the total trading volume reached during the daytime session.

The method for calculating the closing price for contracts will instead remain unchanged. The closing price will continue to be measured against the average, distributed according to quantities, of prices deriving from the last 5% of contracts closed before 17:38.

Will other markets be pushed to behave similarly?

Other markets and European operators have already moved in this direction. Some from the main European markets already run trading activities on the main index until 22:00, thus meeting the needs of overseas investors. An overview of future contracts on the main European indexes suggests that there is the possibility to trade on futures in earlier time sessions than those currently offered by the IDEM Market (opening time set at 9:00) on several other basket trades, including STOXX, DAX Cac 40 o Ftse 100.

What are the benefits linked to the extension of trading hours on IDEM?

A closer alignment to other European, American and Asian financial markets, will allow to exploit new opportunities and the attract foreign direct investments. Besides, new opportunities to create strategies in combination with futures on government debt bonds or futures on trade baskets of other markets will emerge. Today Eurex already offers the possibility to trade 21 hours on 24, and it is gradually aligning itself to the continuous trading offered by the Foreign Exchange Market (Forex).

The new trading times, applied to the FIB and MiniFIB – the main indexes of IDEM – will attract more foreign operators from the Asian and US markets, who will gain extra time to trade on futures. It follows that the volume size on FIB and MiniFIB may grow as a consequence – a growth which may result from the signaling effect produced by the extension of market sessions: the anticipation of the opening for the trading of futures by one hour in comparison to those of other stock markets may provide an indication of the cash market, on the basis of how Asian markets have closed. The extension of the trading hours on index futures until 22:00 will create a closer alignment to US closing times, allowing investors to benefit from upwards and downwards trends.