Legenda - CW & Investment Certificates

Trading Group: it identifies a group of securities characterized by common factors, in particular the Trading Market, the Issuer (for the main ones only), the Trading Hours, the RFE parameter and the Settlement System. At the following link you can find the list of Trading Groups with their respective characteristics: Trading Group

Specialist max spread: specify the maximum price differential that Liquidity Providers must adhere to, calculated as the ratio between the difference between the selling price and the purchase price and their average, which is defined based on the table available in the Guide to the Parameters: Guide to the Parameters

Last Price : price of last contract concluded.

Last Volume : quantity traded in last contract concluded.

Chng% : percentage change calculated as the difference between the Last Price and the previous day's Reference Price.

Time : time when last contract was concluded.

Strike Price: price at which the underlying asset can be bought (CW Call) or sold (CW Put).

Valuation Price: if the Liquidity Provider is present with their quotes in both bid and offer, it is equal to the average between the best bid and offer available in the Central Order Book. If the Liquidity Provider acts in bid only, the evaluation price is equal to the Liquidity Provider's bid price. If the Liquidity Provider is absent, the evaluation price is not calculated.

Closing Price: it is equal to the latest of the following available values: the price of the last contract, the latest valuation price, or the closing price of the previous session.

Day Low/High : minimum and maximum Price recorded by the security during the trading day.

Low/High : minimum and maximum Price recorded by the security since the first trading day of the year.

Accum. Volume : overall quantity of securities traded during the day in Continuous Trading Market Status.

Turnover : security's overall turnover, computed as the product of the Prices and relative quantities.

Lot Size : the minimum number of Covered Warrants, and complete multiples of thereof, which are allowed to be traded in the market.

Type : Call Covered Warrants grant the option to buy on or before the expiry date a certain quantity of underlying assets at a predetermined Price. Put Covered Warrants grant the option to sell on or before the expiry date a certain quantity of underlying assets at a predetermined Price.

Option : European style, if the Covered Warrant can only be exercised on the expiry date. American style, if the Covered Warrant can be exercised at any time from the date of issue up to the expiry date.

Quantity Issued : indicates the number of Covered Warrants issued for each series.

Multiple : indicates the number of underlying assets controlled by a single Covered Warrant.

No. of Trades : number of contracts concluded during the stock exchange day in Continuous Trading Market Status

Market phase : the market phase including the security during the course of the day .

Trend indicator : indicator that records the trend between the last and last-but-one Price of the day (rising, falling and static).

Data update

Last and Chng%: data in real time.

Intraday and Book: 15 minutes delayed data.

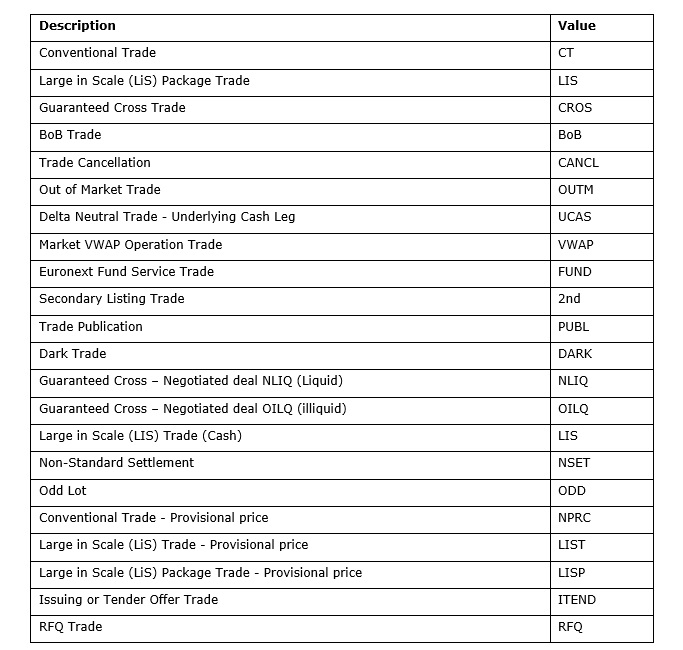

Trade Type